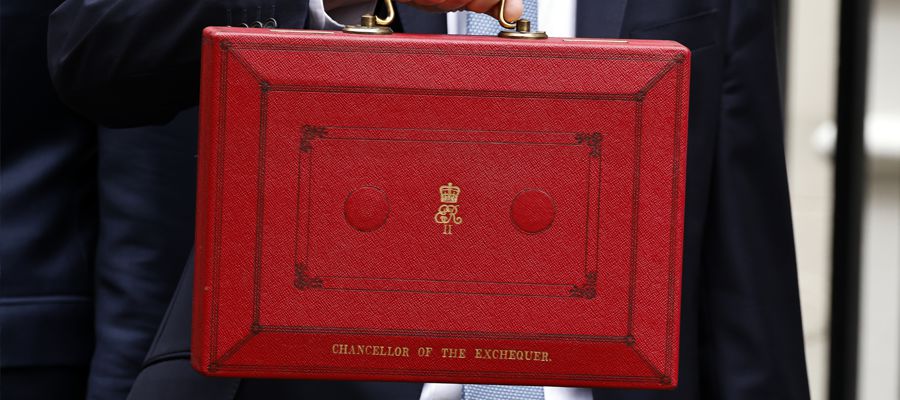

Spring Budget 2020 Summary

- Thursday, March 12, 2020

Rishi Sunak’s first Budget took place against the backdrop of the global outbreak of COVID-19. Not surprisingly the UK’s response to this was the initial focus – providing some much needed short term financial measures in the current uncertainty, from ensuring the NHS has sufficient budget to cope, to extending statutory sick pay rules that affect millions of workers.

Rishi Sunak’s first Budget took place against the backdrop of the global outbreak of COVID-19. Not surprisingly the UK’s response to this was the initial focus – providing some much needed short term financial measures in the current uncertainty, from ensuring the NHS has sufficient budget to cope, to extending statutory sick pay rules that affect millions of workers.

The new Chancellor set out a Budget which supports the government’s ambition for a ‘fair and sustainable tax’ system.

Many rumours didn’t quite come to pass, we did not see an overhaul of inheritance tax, scrapping of Entrepreneurs Relief or an announcement of a wide spread review of pensions tax relief. But as expected we did see an increase in the Tapered annual allowance, and the good news was it was significantly more than expected, saving many from significant tax bills and the hassle of carrying out complex calculations.

Income tax

- Starting rate for savings tax band – form savings income that is subject to the 0% starting tax rate remains at £5,000.

- Income tax bands and Income tax rates remain unchanged

Income tax band for 2020/2021:

- Basic Rate £1 – £37,500

- Higher Rate £37,501 – £150,000

- Additional Rate Over £150,000

National Insurance

- The threshold at which employees will begin paying class 1 National Insurance increases from £8,632 to £9,500 from 6 April 2020.

Corporation Tax - The Government has decided not to reduce the rate of corporation tax from the planned 19% to 17% and instead it will remain unchanged at 19% from 1 April 2020.

Capital Gains Tax

- Capital Gains Tax: Reduction in the Entrepreneurs’ Relief lifetime limit.

- From 11 March 2020, the lifetime limit on gains eligible for Entrepreneurs’ Relief (which offers a reduced 10% rate of Capital Gains Tax on qualifying disposals) will be reduced from £10 million to £1 million. There are special provisions for contracts for disposals entered into before 11 March 2020 that have not been completed and for certain exchanges of shares and securities made before 11 March 2020. The change ensures the Government continues to encourage genuine risk takers and entrepreneurs’ in a fair way, with over 80% of those using the relief unaffected.

Inheritance Tax

- Other than the planned increase to the Residence Nil Rate Band (from 150,000 to 175,000 from 6 April 2020), there are no other changes to Inheritance Tax.

Pensions

Changes to annual allowance

The standard annual allowance in 2020/21 will remain at £40,000.

However, to support the delivery of public services (particularly health services) the two tapered annual allowance thresholds will be raised by £90,000.

Therefore, from 2020-21 the:

a) ‘threshold income’ will be increased from £110,000 to £200,000; and

b) ‘adjusted income’ will be increased from £150,000 to £240,000.

For those with a threshold income above £200,000 and an adjusted income above £240,000, their annual allowance will be reduced by £1 for every £2 that their adjusted income exceeds £240,000, down to a minimum (tapered) annual allowance of £4,000 (£10,000 in 2019/20).

This means that anyone with a threshold income above £200,000 and an adjusted income of at least £312,000 would have a tapered annual allowance of £4,000 in 2020/21.

There is no associated proposal to offer greater pay in lieu of pension benefits for senior clinicians in the NHS pension scheme.

This measure is primarily designed to enable most clinicians to work more hours without incurring pension tax charges.

Change to lifetime allowance

The standard lifetime allowance (SLA) will be revalued (in line with the annual increase in the consumer prices index (CPI) to September 2019) from £1,055,000 in 2019/20 to £1,073,100 in 2020/21.

Call for evidence on pension tax administration

There is a tax relief inconsistency for those earning around, or below, the level of the personal allowance depending upon whether they are contributing to a:

a) relief at source (RAS) registered pension scheme, such as a personal pension; or

b) net pay arrangement.

Those contributing to a RAS scheme currently benefit from UK basic rate income tax relief whilst those contributing to a net pay arrangement scheme do not. Therefore, the government will consult regarding how to address this unequal treatment.

Inheriting a State Pension from an opposite sex civil partner

The Civil Partnerships (Opposite-sex Couples) Regulations 2019 gave opposite-sex couples the choice of entering into a marriage or a civil partnership.

The Budget provides funding to ensure that opposite-sex individuals who enter into a civil partnership can derive, or inherit, a State Pension from their (opposite-sex) civil partner.

Universal Credit: Additional support for claimants transferring to pension credit

This measure allows Universal Credit payments to be extended until the end of the assessment period in which the household reaches the qualifying age for Pension Credit and pensioner Housing Benefit. This removes the potential gap in benefit entitlement that exists at the moment.

Consultation on the reform of Retail prices index (RPI) methodology

The method for calculating the RPI, which is widely used in the pensions industry, for instance in relation to revaluing pension benefits in deferment and pension income payments, has been reviewed by the UK Statistics Authority (UKSA). A consultation will now run until 22/04/2020 with regard to making any changes at some point between 06/04/2025 and 06/04/2030.

Individual Savings Accounts (ISA)

- There are no changes to the adult ISA annual subscription limit for 2020-2, it remains unchanged at £20,000.

- The Junior ISA subscription will increase from £4,368 to £9,000.

Top Slicing Relief

Following Marina Silver v HMRC, new legislation has been introduced to clarify the top slicing calculation for gains made on or after 11 March 2020. The new legislation confirms:

For the purpose of the top slicing calculation reliefs and allowances are to be set against other income as a priority. Only if there are allowances remaining are they to be set against the chargeable event gain(s)

When assessing the tax due on the annual equivalent (the gain(s) divided by the years made over) the availability of the personal allowance should be assessed using the annual equivalent not the full gain(s).

This applies to both Onshore and Offshore life assurance and redemption policies.

Stamp Duty

Non-UK resident Stamp Duty Land Tax (SDLT) surcharge

A 2% surcharge on non-UK residents purchasing residential property in England and Northern Ireland will be introduced from 1 April 2021. The surcharge is in addition to the standard Stamp Duty rates as well as the 3% surcharge that the Government previously introduced for buy to let properties and second homes.

Housing co-operatives: Annual Tax on Enveloped Dwellings (ATED) and SDLT

The government will introduce a relief for qualifying housing co-operatives from the ATED and 15% SDLT on purchases of dwellings over £500,000. The SDLT relief will take effect in England and Northern Ireland from the Autumn Budget and the UK-wide ATED relief from 1 April 2021 with a refund available for 2020-21.

Tax evasion and promoters of tax avoidance schemes

HMRC’s continues to push its Promoter strategy. HMRC will publish a new strategy for tackling the promoters of tax avoidance schemes with an aim of driving those who promote tax avoidance schemes out of the market, disrupt the supply chain to stop the spread of marketed tax avoidance, and deter taxpayers from taking up the schemes.

Chris Davies

Chartered Financial AdviserChris is a Chartered Independent Financial Adviser and leads the investment team.

About Estate Capital

Financial Services

Our Contacts

7 Uplands Crescent,

Swansea, South Wales,

SA2 0PA.

Tel: 01792 477763