Financial & Investment News

Keep up to date with financial news and information

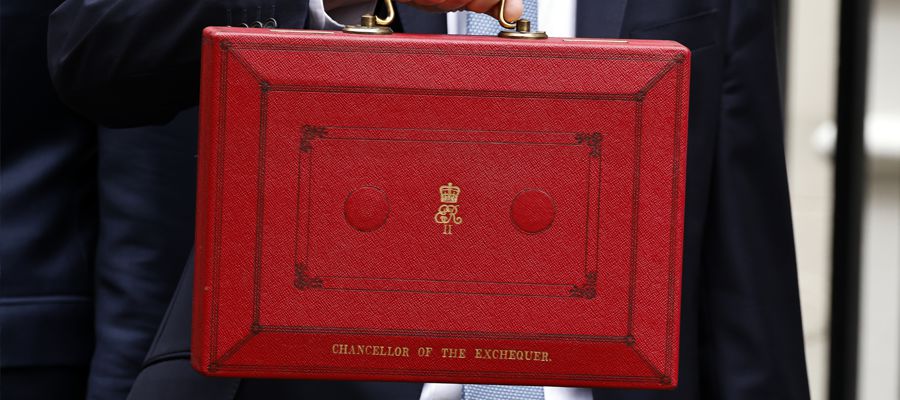

Main Residence Nil Rate Band and Existing Nil Rate Band

- Monday, April 17, 2017

In the recent July budget, legislation was introduced to provide for an additional main residence nil rate band for an estate if the deceased’s interest in a residential property, which has been their residence at some point and is included in their estate, is left to one or more direct descendants on death. A direct descendant will be a child (including a step-child, adopted child or foster child) of the deceased and their lineal descendants.

In the recent July budget, legislation was introduced to provide for an additional main residence nil rate band for an estate if the deceased’s interest in a residential property, which has been their residence at some point and is included in their estate, is left to one or more direct descendants on death. A direct descendant will be a child (including a step-child, adopted child or foster child) of the deceased and their lineal descendants.

The value of the main residence nil rate band for an estate will be the lower of the net value of the interest in the residential property (after deducting any liabilities such a mortgage) or the maximum amount of the band. The maximum amount will be phased in so that it is:-

- £100,000 for 2017 to 2018

- £125,000 for 2018 to 2019

- £150,000 for 2019 to 2020

- £175,000 for 2020 to 2021

It will then increase in line with CPI for subsequent years.

The qualifying residential interest will be limited to one residential property but personal representatives will be able to nominate which residential property should qualify if there is more than one in the estate. A property which was never a residence of the deceased, such as a buy-to-let property, will not qualify.

A claim will have to be made on the death of a person’s surviving spouse or civil partner to transfer any unused proportion of the additional nil-rate band unused by the person on their death, in the same way that the existing nil-rate band can be transferred.

The legislation will also extend the current freeze of the existing nil-rate band at £325,000 until the end of 2020 to 2021.